The need for a credit enquiry often arises when any person requires a loan or credit card. While some do a credit enquiry just to check their credit score, others take a step further and apply for a fresh credit. Once they apply, lenders will do a credit enquiry too.

But how do these credit enquiries impact you?

Firstly, the impact of these enquiries on your loan and credit card prospects may not be the same. The variation could be due to differences in the credit record of individuals. While some can have an excellent repayment track showing no spot of payment delays or defaults, others may have repayment issues. Accordingly, the result of credit enquiries will vary.

Are you one of those wondering what is the big fuss about hard credit inquiries and your credit reports?

Considering all these, we have made it a point to define what is a credit inquiry and how to remove them from your credit report.

What Exactly is a Hard Credit Inquiry?

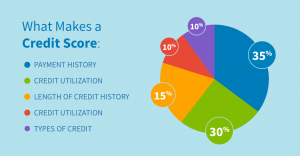

A credit inquiry refers to the application made by an y individual for applying for a credit product, be it loan or credit card, and the lender fetched your credit report from the credit bureau to determine your creditworthiness. All such inquiries are reflected in your credit report. It is one of the key factors your credit score depends on.

How Long do Hard Inquiries Stay on your Credit Report?

Inquiries can stay on your credit report for up to 2 years. Each time an inquiry is made, it is recorded by each of the three credit bureaus – Equifax, Experian, and TransUnion. And each time an inquiry is logged, it can potentially affect your credit score.

What are Inquiries and How do They Affect my Credit Score?

On your credit report, at the end of the report, you will notice a section called “Credit Inquiries.” These inquiries are made by companies that have checked your credit report, usually to judge your creditworthiness for a loan or credit card.

How much “new credit” you have accounts for 10% of your total credit score. Here’s a basic breakdown of this category and how it impacts your score.

- New Accounts: Your score is affected by how many types of new accounts you have in different account categories. Installment loans like mortgages or student loans are typically looked upon more favorably than revolving credit like credit cards.

- Amount of Recent Inquiries: The calculation also includes how many inquiries have been pulled in the last two years.

- Length of Time Between Inquiries: Your score drops for 12 months after an inquiry but each one stays listed on your report for two years.

- Length of Time Since You Opened an Account: Your score is also affected by how long it has been since you opened a new credit account. The longer it’s been, the better for your credit score.

How Important is it to Remove Inquiries?

Inquiries are the least important items to remove from your credit report compared to other negative items like missed payments and delinquent debts.

They have a relatively low effect on your credit score and cause less and less damage over time. Because they only affect your score for 12 months and drop off entirely after two years, inquiries are by no means the worst thing you can have on your report.

Many negative items stay on there for anywhere between seven and ten years. So if your credit report is riddled with several severe negative items, then removing inquiries from your credit reports should be your last priority as you work on increasing your overall scores.

It often helps to talk to a professional credit repair company to help you analyze your credit report and prioritize issues that need to be addressed.

Plus, they have the legal know-how of what your rights are with your different creditors and how likely you are to get certain items removed.

What is the Difference Between a Hard and Soft Credit Inquiry?

Hard inquiries affect your credit scores while soft inquiries do NOT affect your credit scores.

Hard inquiries occur when you apply for new credit, such as a mortgage, car loan, or credit card. But other requests can trigger a hard inquiry, including those pertaining to a new insurance policy, job application, or cell phone.

Whenever this happens, the inquiry is listed on your credit report, along with the date it was requested. That’s when the two-year countdown to removal begins.

Soft inquiries, on the other hand, occur when a creditor checks your credit without your permission. This could be a lender with whom you’ve talked to for a pre-approval quote but haven’t actually applied for a loan.

By doing a soft credit pull, they can give you an idea of your interest rate offer without actually having to do a hard inquiry that will affect your credit score.

Sometimes a soft inquiry might even be pulled by an existing creditor just checking on your current credit situation. Another example of a soft inquiry is a company that would like to send you a credit card or other loan offer.

How do Credit Inquiries Affect your Credit Score?

Sometimes inquiries don’t affect your credit score at all. Other times they can affect it by up to 5 points each. However, having too many inquiries on your credit report at once can indicate to a creditor that you are desperate for money and may be in trouble financially.

They may also assume that you’ve recently opened up a bunch of new accounts and could deny you credit because new lines of credit often take time to show up on your report.

Plus, while 5 points may not seem like a lot, it can quickly add up if you have applied for many loans or credit cards over the last two years.

Even though the impact on your credit score lessens over time, lenders will still be able to see the full list of inquiries at the bottom of your credit report for a full two years.

Also, remember that the difference between being approved or denied for credit, or getting a lower or higher interest rate, is typically decided based on pre-set score ranges.

If your credit score is on the cusp between “poor” and “fair,” 5-10 points might make all the difference in getting better loan terms.

Those one or two credit inquiries could be all that is standing between you and a better rate, or access to a loan at all. So while inquiries may not have a huge impact on credit for some people, they can leave a lasting imprint on the financial lives of many.

Does Checking your Credit Hurt your Credit Score?

Checking your own credit, whether you are checking your credit report or your credit score is also considered a soft inquiry and does not hurt your credit score.

Do Credit Bureaus Group Multiple Inquiries Together?

It’s important not to apply for too many types of loans at one time.

However, if you are shopping around for one type of loan, like a mortgage, and decide to apply for several different loans to compare terms and rates, the multiple inquiries count as just one towards your credit score.

The same goes for credit cards and auto loans. These multiple inquiries do not affect the credit score as long as they occur within a 30-45 day period.

Don’t start applying for credit until you’re serious about it, then you can stick to this time frame.

If you are just shopping around, you’ll start to have separate inquiries stack up on your credit report when they are spread out over time. It always helps to have a financial goal with a deadline so you can plan your inquiries in advance.

Lenders have become increasingly lenient in this regard because they know that today’s consumers are more likely to perform their due diligence before making a major financial decision. This includes researching and shopping around for loans to find the best rates and terms.

If you’re not applying for too many types of loans at the same time, then you probably won’t have to worry about disputing inquiries — you can just leave them alone.

However, if you have several different types of inquiries, you may want to consider disputing them because they can add up as lost points. And if your credit score is borderline between two scoring categories, then every few points can make a difference.

How Can I Remove Inquiries From my Credit Report?

Because you often don’t control who is pulling your credit report, your first step is to request a copy of your credit report to review all of the items listing in the Credit Inquiries section.

Check each item carefully and if it isn’t something that you authorized, it’s time to dispute the item and have it removed. There are two ways of doing this.

The first way is to tackle the dispute process on your own. Get the address of each creditor whom you did not approve to perform a hard inquiry.

Then send them a certified letter in the mail (make sure you keep a copy for your records) stating that the inquiry was unauthorized and should be removed immediately.

Here’s a complete list of instructions on our Credit Inquiry Removal Letter page.

If you have other negative items on your credit report that need to be dealt with, you may consider hiring a credit repair company.

You probably don’t want to do that if you’re just working on removing credit inquiries, but if there are other issues then a professional can help expedite the process and save you tons of time dealing with your creditors on the phone and through letters.

To prevent future unauthorized inquiries, consider placing a freeze on your credit report. This option prevents any lenders or creditors from accessing your credit information.

It’s great for preventing identity theft because no one can open an account using your financial information since they won’t get approved for a loan or credit card without a credit check. However, it also helps prevent unwanted inquiries if you find this to be an ongoing headache.

Placing a freeze on your report and having it removed both incur separate fees in most states, so don’t do this if you’re planning on applying for a loan or credit card in the near future.

But if you anticipate your financials to remain the same for the time being, this can be a convenient option to keep your credit report — and score — nice and clean.

Source: Lauren Ward [https://www.crediful.com]